Non Resident Speculation Tax is coming to Teraview on the Web

Number: 17-32

Effective December 30, 2017, Teraview on the Web will be enhanced to calculate and collect the Non Resident Speculation Tax (NRST). See below for information on the collection of NRST in Teraview on the Web. If you are using Teraview 9.0 please see the newsletter specific to Teraview 9.0.

How will the system determine when to calculate/collect NRST?

The system will determine if the conveyance is subject to NRST by the selection of either statement 9171 or 9172 located in the explanations section of the Tax branch.

| 9171 | This conveyance is subject to additional tax as set out in subsection 2(2.1) of the Act. |

| 9172 | This conveyance is subject to additional tax as set out in subsection 2(2.1) of the Act. This is a conveyance of a combination of “designated land” and land that is not designated land. The transferee(s) has accordingly apportioned the value of the consideration on the basis that the consideration attributable to the conveyance of the designated land is AMOUNT and the remainder of land is used for TEXT purposes. |

It is important to note that the NRST will be calculated and collected regardless of the LRO in which the transaction is taking place. As such, it is imperative that the statements are only selected when NRST is applicable. Information on NRST and what conveyances are applicable can be found on the Ministry of Finance website.

What will happen to my signed work in progress Instruments?

Any signed Instruments that have statement 9171 or 9172 already selected will have the NRST calculated and collected upon registration. There will be no need to re-create or re-sign your Instruments. Please review the LTT and NRST owing prior to registration to ensure you have enough funds in your account.

What will happen to Instruments registered prior to December 30th, 2017?

These Instruments will not be impacted by this change.

How will I know how much NRST will be collected?

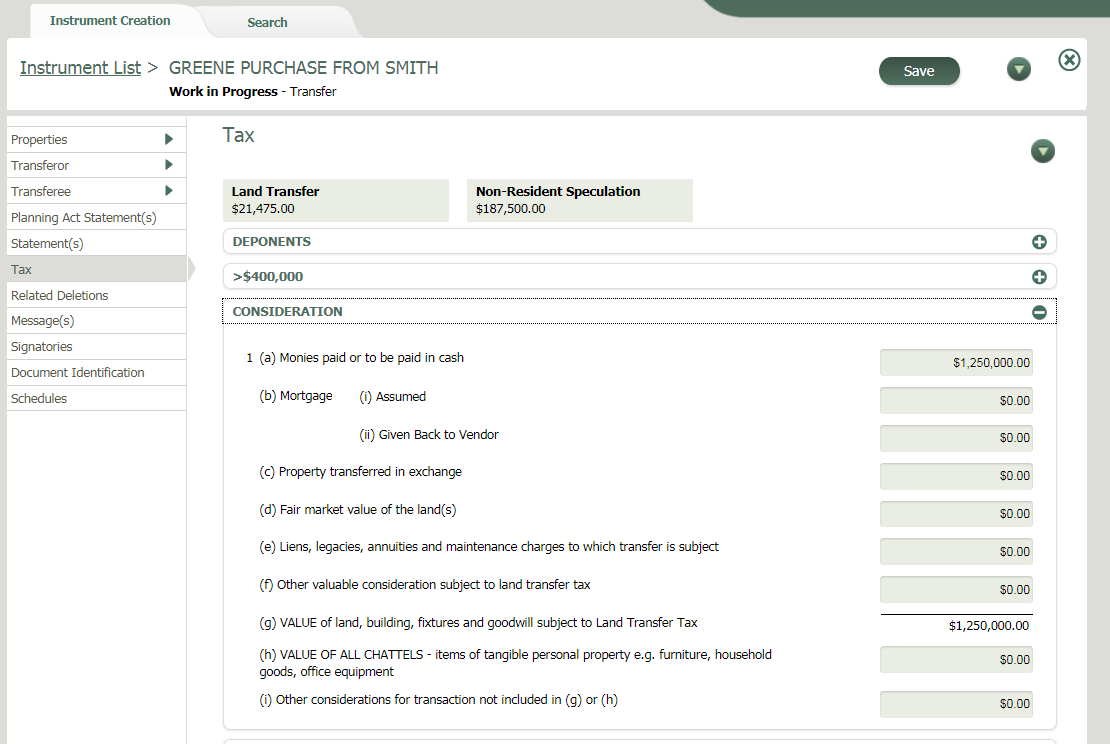

On Screen

The amount of NRST payable will be displayed in the Tax branch in the Non-Resident Speculation field next to the amount of Land Transfer tax payable.

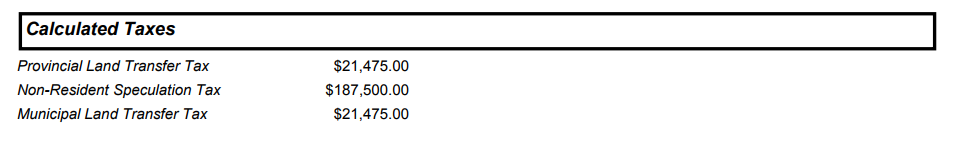

Acknowledgement and Direction and Document Preparation Reports

The amount of NRST payable appears in the Calculated Taxes section.

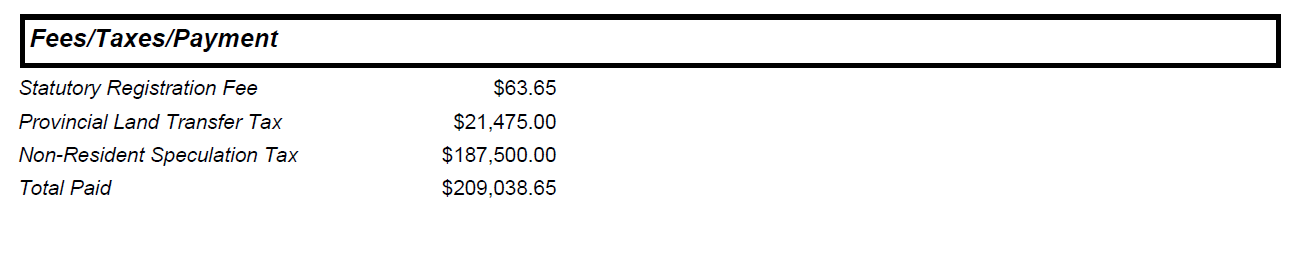

Instrument PDF obtained at registration

The amount of NRST payable appears in the Fees/Taxes/Payment section.

Where will the NRST be debited from?

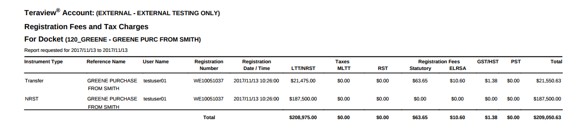

The NRST amount will be debited from your designated Electronic Registration Bank Account (ERBA). This is the same account where registration fees and Land Transfer tax is currently debited from. The amount of NRST debited will also appear on the Docket Tax/Fee Summary Report and Electronic Registration Activity report for your records.

What if I have already paid the appropriate taxes in advance?

If payment has already been submitted to the Ministry of Finance, please ensure that the NRST amount owing displayed in the Instrument is $0.00 or NRST will be collected again. For Instructions, please visit the Ministry of Finance NRST website.